1st Issue of

November 2006

New Homes: The Five-Year Picture

The current over supply situation became undeniable when our

market exceeded the historical record for specs eight months ago (2,400 specs

reported the week of January 15th).

This article provides you with a historical perspective and a glimpse of

the bigger picture of the new homes market than the Current New Homes Market

article.

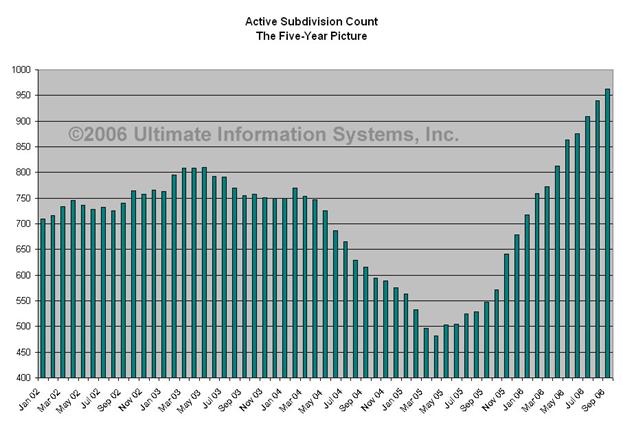

Five-Year Subdivision Count

The following five-year graph shows a normal ebb and flow of

active subs; the count climbs in late spring, when builders are presumably

preparing for the summer when sales are typically higher, and declines a little

in late summer. In 2004 and 2005 the

active sub count dropped dramatically with the investor/speculator boom, when

plans for coming subdivisions could not be acted upon as fast as active

subdivisions were selling out. The

lowest count was 482 active subs in May 2005.

Compare that with the current count of 980 active subs and you can see

that the active sub count has more than doubled in the past year and a half!

We define an active subdivision as one accepting contracts

from qualified buyers. The subdivision

count data we report comes from the Ultimate

New Homes (UNH) database, which covers the entire

For more on

the UNH Database, please see the Current New Homes Market article in this

issue.

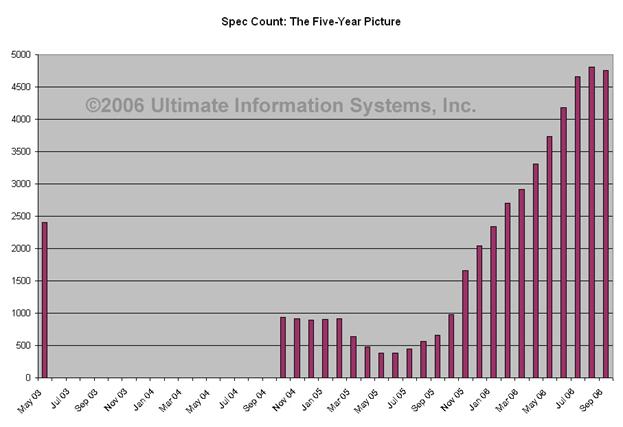

Five-Year Spec Count

The UIS spec count is made up of the individual properties

that each subdivision chooses to report to us to be included in our system for

ARMLS affiliates. The degree of completion will vary from builder to

builder and from one subdivision to another.

We believe our current count is on the conservative side, as some subdivisions

do not report their total specs to us.

We only have comprehensive spec data going back through

October 2004. Prior to that our data is spottier,

but we know that the highest historical spec count was 2,400 in May 2003. Even with this partial data a pattern is readily

apparent. Spec counts maintained a modest

level through 2004, and bottomed out in 2005 during the real estate boom when

supply struggled to keep up with demand.

Since October of last year, however, the spec count climbed steadily. Only in the past month has it fallen off, but

it is still almost ten times what it was at the lowest point in June 2005 and

twice the number of anytime prior to 2006.

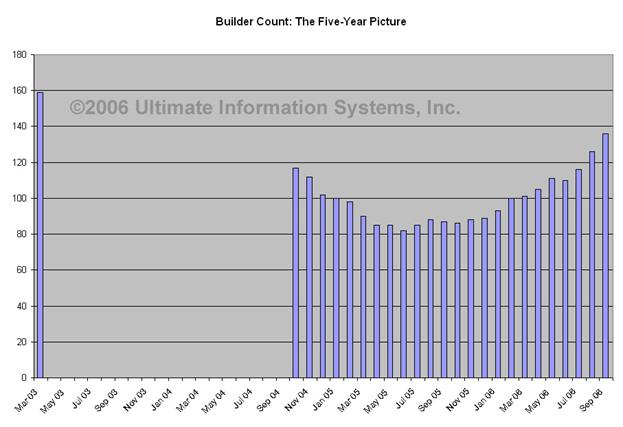

Five-Year Builder Count

Again, here we are lacking complete five-year data, but a pattern

is still visible. We have the highest

historical builder count in March 2003 (159 builders), and a slow decline of

builders since then. The builder count

started rising again in June 2005, and is now back up to 139.

Commentary

The subdivision and spec counts and graphs clearly

illustrate that the

It is our belief that we will not see what would be

considered a normal market until the spec count has been reduced to about 2,500

and the subdivision count is back in the range of 800. However, even when these levels are reached

the resale inventory must be considered. Therefore, we conclude that we are

still many months away from a balanced market.

CopyrightŪ 2006 - This information is compiled and

written by Ultimate

Information Systems, Inc. Use of this article, in part or in its entirety,

is expressly prohibited without written permission. Click

here to request limited rights to reuse this information.